I’m Steve Vollenweider, owner of Best Plan Insurance. Through being a successful business owner for 25 years as well as a licensed insurance agent, I’ve had the opportunity to develop connections in the health insurance marketplace with some of the most reputable health insurance providers in the industry, specifically for individuals and small businesses.

Trusted Providers

Choosing the right health insurance policy is essential for protecting your health and financial well-being. Here are some reasons why selecting a proper health insurance policy is important:

Medical treatments can be very expensive, and without health insurance, you may have to bear the full cost of medical expenses out of your pocket. Having a health insurance policy can provide financial protection against unforeseen medical expenses.

With a good health insurance policy, you can access quality healthcare without worrying about the cost of treatment. You can choose from a wide range of hospitals and doctors that are empaneled with your health insurance provider.

Having a health insurance policy can give you peace of mind, knowing that you are protected against unexpected medical expenses.

Some health insurance policies cover pre-existing medical conditions, which means that you can get treatment for your existing health issues without worrying about the cost.

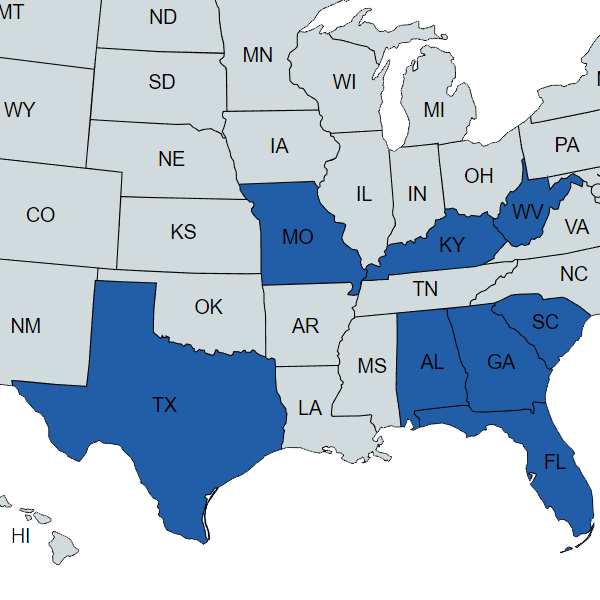

- Georgia

- Florida

- Alabama

- South Carolina

- Kentucky

- Missouri

- West Virginia

- Texas

To learn more about the best types of health plan coverage for you, fill out a contact form, and I will be in touch with you shortly. If you don’t see your state on the list, don’t worry! We can still help you, and if we can’t, we can get you in contact with the right person.

It’s important to note that there are many different types of health insurance plans, and they are often broken down into the three categories listed below. Each of these plans has its own costs and benefits, so it’s important to carefully consider your options and compare different plans to find one that fits your needs and budget.

Common Plans

ACA Exchange

High Deductible plans outside ACA

Short Term Medical plans

Indemnity with Catastrophic Wraparound plans

Common Plans

Medicare Supplement Plans

Stand-alone Medicare Prescription Drug Plans

Medicare Advantage plans

Common Plans

Stand Alone Accident plans

Stand Alone Critical Illness plans

Dental

Vision

Hearing

Combined DV, DVH plans